At retirement from the Columbus Retirement Fund, you have certain options. As this money will have to last you for the rest of your life, it is important that you don't take any decision at retirement lightly. It is recommended that you speak to a financial advisor to assist you with this important step.

What is my retirement benefit?

The normal retirement age of the Fund is 65 years. At retirement you will get your entire Fund Credit less any permissible deductions.

- Your Fund Credit includes:

- Your employee contributions towards the Fund

- Your employer contributions towards the Fund

- Less: any administration fees and other expenses

- Less: any risk benefit costs

- PLUS: any investment returns earned

- Permissible deductions which may be deducted from your Fund Credit before your retirement benefit is paid, include the following:

- Amounts awarded to an ex-spouse via a divorce order

- Arrear maintenance payments awarded via a court order

- Losses suffered by the employer as a result of fraud and theft by the employee, and in respect of which the member admitted liability in writing, or judgement has been obtained against him / her.

- Tax deductions as per the tax directive provided by SARS.

- The Two-pot retirement system introduced a ‘retirement’ and a ‘savings’ pot, which will take effect from 1 September 2024.

- Click here for more information Two-Pot Retirement System which starts on 1 September 2024.

It is imperative that you discuss your options with your financial advisor before you make a final decision regarding withdrawal from the Fund.

New Two-Pot Retirement System information

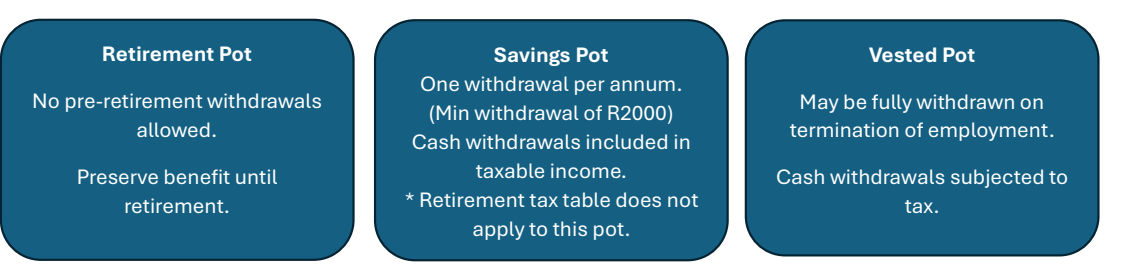

Pre-retirement withdrawal:

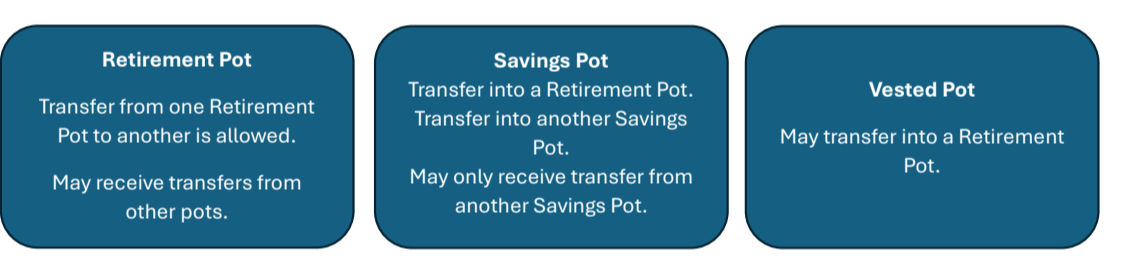

Transfers between Pots:

NOTE: Transfer to another retirement fund is allowed. The retirement and savings pot cannot be split and transferred into two different retirement funds i.e. these two pots must be transferred to the same fund.

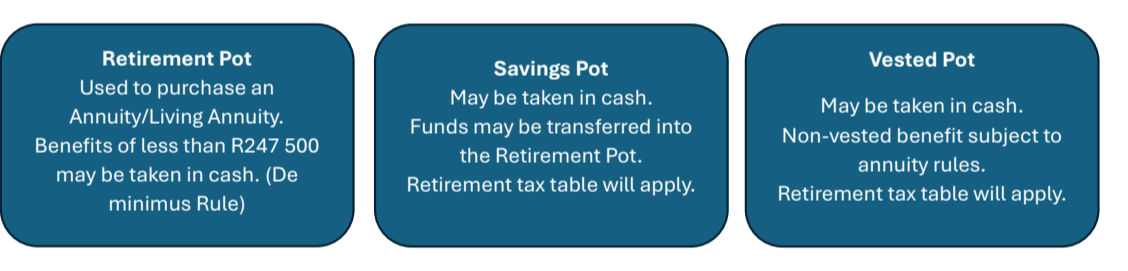

Options at Retirement:

* Annuity Rule: Purchase annuity with at least 2/3rds and may take 1/3rd in cash. (De minumus Rule also applies – Current value R165 000)

Life Annuities vs Living Annuities

You will have two general options to consider if you are close to retirement: A LIFE ANNUITY or a LIVING ANNUITY.

- LIFE ANNUITY:

- You will receive a pension for the rest of your life.

- The amount of your Fund Credit used to purchase the annuity ultimately determines the amount you will receive each month. The more you contributed, the higher your monthly pension will be after retirement.

- LIVING ANNUITY:

- You choose how much money should be taken out of your savings to pay your pension every month.

- All of your money will stay invested after you retire. This means that your savings can increase or decrease in value after you retire, depending on market movements.

Important: if you want to take a living annuity when you retire, the default Age-related option offered by the Fund may not be right for you. Speak to your financial advisor before it’s too late to change your mind!

| LIFE ANNUITY | LIVING ANNUITY |

|---|---|

| Your monthly pension is guaranteed for life. |

Your pension can be changed every year (between 2.5% and 17.5% of your capital). |

| Income tax cannot be managed as the tax is based on your monthly pension. | Income tax can be managed by reducing the monthly pension you withdraw. |

| The insurer will determine the investment strategy of the underlying investments. | The choice of underlying investments rests with you and your advisor. |

| Various options are available and differ from insurer to insurer. | Capital goes to your beneficiaries if you die. They can continue to withdraw an income, or they can withdraw the capital. |

| The insurer takes on the investment risk. Your monthly pension is guaranteed. | You take on the investment risk. Together with your advisor, you must ensure that your investment returns provide a pension that you will be able to live on for the rest of your life. |

| Your choice is final and cannot be changed. | A Living Annuity can be switched to a Fixed Annuity at a later stage. |

Voluntary early retirement

Members, with the employer's consent, may retire early from age 55 onwards. You will have the same options as under Normal Retirement above.

Ill-health retirement

At the request of the employer, a member may be retired at any time before the member's normal retirement age, due to retrenchment or ill health which, in the opinion of the medical advisor selected by the trustees, renders the member incapable of efficiently performing his / her duties, provided the member is not found to be disabled in terms of the requirements as set out in the Employer Disability Income Scheme Policy.

In this case the Normal Retirement benefit is payable.