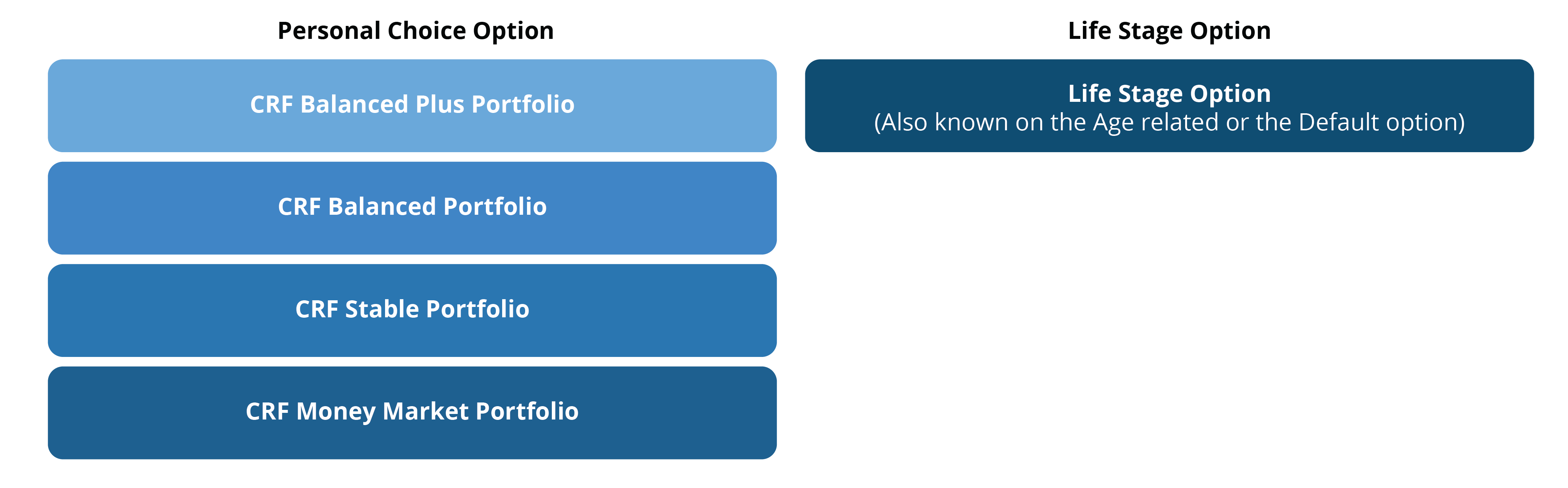

Members of the Columbus Retirement Fund have the following investment options to choose from:

Should you do not exercise an option, your savings will be placed in the Life Stage Option.

Let's take a look at each of these portfolios (for more detailed information on each portfolio, download the portfolio Fact Sheets):

A comparison of the portfolios on offer:

You may switch between the options and portfolios any time. Please, however speak to your investment advisor. Three switches a year are free, the other switches are charged at R350 per switch, which is deducted off your Fund Credit at the time of making the switch.

Members can switch their retirement fund money between the different portfolios by completing an Investment Option Form.

If you do not exercise an option, your savings will be placed in the Life Stage Option.

If you do not have an investment advisor, please contact us at yourfund@columbus.co.za, and we will link you with an advisor to the fund.