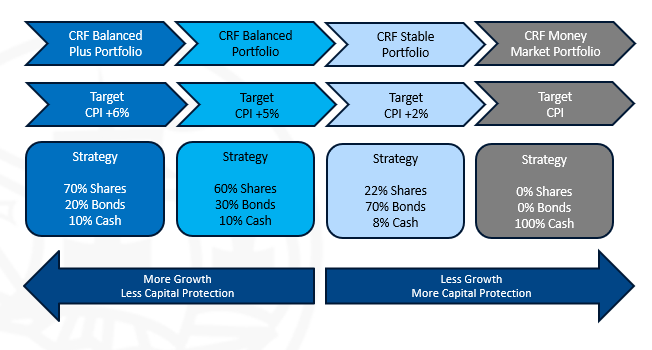

Members of the Columbus Retirement Fund have the following investment options to choose from.

The Fund Credit of members who do not make a selection will be invested in the Age-related (Default) Option:

To read more about these portfolios, please click here.

What options do I have?

You can either choose the Life Stage Option or the Personal Choice Option. If you choose the Personal Choice Option, you may invest your Fund Credit in any one or combination of the four portfolios named above. Your options can vary for your Fund Credit and for your future contributions (they do not have to be in the same portfolio). The only requirement is that there has to be a minimum of 25% of your contributions invested in any one portfolio at any time.

What happens if I do not make a choice?

our Fund Credit will be invested in the Default Life Stage Option.

Click here to read more about this option.

How do I switch?

Members can switch between these portfolios any time, except if they are invested in the CRF Stable portfolio. If you want to switch money into or out of the CRF Stable portfolio, the switch will only be implemented on 1 January and 1 July of every year. It is important to note that you have to give five months notice for CRF Stable Portfolio transactions. For the other portfolios, your switch will be actioned within 10 days after the administrator has received your option form.

What does it cost?

Three switches a year is free, the other switches are charged at R250 per switch, which will be deducted from your Fund Credit at the time that you make the switch.

Where can I switch?

Members can switch their retirement fund money between the different portfolios by completing the Investment Option Form.

Fax or e-mail the completed and signed option form to:

Ensimini Financial Services, Administrator

Tel: +27 11 381 7960

E-mail: yourfund@columbus.co.za